Correct monitoring ensures dependable monetary statements, fostering transparency that is vital for inside selections and instilling confidence in traders, lenders, and regulators. Recording commissions within the correct accounting interval is essential to ensure accurate monetary reporting. The Journal Entry for Commission Due is recorded when fee earnings is earned however not yet acquired.

Let’s see the entries in the entity’s books paying the fee. Nominal Account’s golden accounting rule is to debit all expenses and losses and credit score all incomes and positive aspects. On 15 December, Firm receive the fee from XYZ, so the must report cash of $ 5,000 and credit commission receivable $ 5,000. Purchasing course of entails numerous steps ranging from putting an order and ending with the supply of goods. Aside from the cost incurred in buying the goods, any further bills like Carriage, Import Duty, etc is also paid. Any expenses incurred during the buy of goods might be shown separately in distinction to an expenditure on assets.

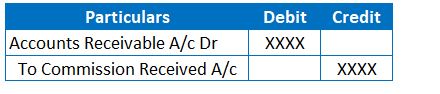

The journal entry is debiting fee receivable and credit score commission income. Sometimes a business does not personal any particular kind of property, plant, and/or machinery. They take the required asset on lease and pay the pre-specified installment for the asset by means of money or cheques. Rent paid journal entry is handed to find a way to report the mandatory lease payments against rented property. Income recognition is important in commission accounting, determining when commission funds are recorded and affecting monetary statements. It aligns sales recording with actual money receipt, sometimes when goods are delivered or companies are completed.

Lease Paid:

In the CPA examination, this topic falls under FAR (Financial Accounting and Reporting). Figuring Out tips on how to record fee income underneath US GAAP and using correct journal entries and disclosures are essential for accurate financial assertion preparation and compliance. You report fee beneath the Indirect Income head within the https://www.intuit-payroll.org/ Profit & Loss account.

- To cross a commission entry in Tally, follow these simple steps depending on whether or not the fee is received or paid.

- For funds to brokers, a paid commission to agent journal entry ensures transactions are accurately cataloged, stopping misstatements in revenue statements.

- This transaction must be recorded promptly to replicate both the increase in earnings and the rise in cash on hand.

- When a company sells items on behalf of another, it earns a part of the gross sales value as a fee.

- The fee obtained is usually thought of earnings, and it will increase the money or bank account.

Query 2: Accounting For Real Property Commissions

This ensures honest practices and helps moral obligations and strategic goals. Automation in fee calculations can considerably minimize errors. By using specialized accounting software, companies can streamline processes. This efficiency permits financial groups to focus on strategic analysis quite than guide duties. Each transaction should be documented meticulously to offer a transparent audit trail. These inaccuracies can additional trigger delays in fee payouts.

Understanding That “it Isn’t Knowledge However Authority That Makes A Law T – Tymoff” – All You Want To Know In 2024

But here is a standard state of affairs given for recording commission earnings. Excellent wage journal entry is handed to document the wage that’s due concerning the workers however not but paid. When salary is not paid on time, it’s shown beneath the Liabilities side of the stability as an ‘Outstanding Wage’ which implies it has now become the legal responsibility of the agency to pay salaries. Any quantity spent so as to buy or promote goods or providers that generates revenue within the enterprise is called expenses. The Cash Account will be decreased with the quantity paid as bills, so it will be credited and Expenses might be debited. Treatment of Fee Obtained in final accounts The commission obtained shall be shown in earnings aspect of profit and loss account since it’s a revenue income.

They only obtain when they are making gross sales for the shoppers. Fee received is the amount that an individual receives in exchange for the providers offered by him/her. It is a kind of monetary remuneration that’s stated to be the asset of the individual/company. Commission obtained journal entry is handed to be able to show the quantity that an individual/a company acquired in change for their providers as commission. When a enterprise receives a commission, it must report the commission receipt transaction in its accounting information. And no matter commissions will be entered in the data, it’s going to rely upon the character of fee.

Salespeople need to report their fee revenue as a part of their taxable income. Companies should guarantee compliance by documenting commission payments appropriately. Fee accounting is grounded in fundamental accounting ideas that ensure financial statements precisely reflect a company’s profitability and financial health. It is intently linked to how properly the sales group performs and to totally different business transactions, together with insurance policies like clawbacks in sales commissions.

Commission revenue is money earned by an individual or business for promoting a services or products. Fee is often calculated as a proportion of the sale proceeds. By the top, you ought to have a comprehensive understanding of the commission accounting you obtained. You might be equipped to implement environment friendly practices that align along with your company’s goals and maintain worker satisfaction.

Fee Receivable refers to fee revenue that has been earned but not but received by the top of an accounting period. It is considered an accrued income and is recorded as an asset in the steadiness sheet. This ensures that the income is acknowledged within the right period, following the accrual foundation of accounting, although the actual cost is pending.